Insolvency avoidance

Our insolvency avoidance insurance

What is insolvency avoidance?

The insolvency administrator is entitled to reverse the effects of certain legal acts performed by or with the debtor shortly before the opening of insolvency proceedings to the detriment of the insolvency creditors and to draw the assets sold to the insolvency estate (sections 129-147 InsO).

An insolvency avoidance is the avoidance of legal acts performed by the insolvency debtor prior to the opening of the insolvency proceedings and which disadvantage the insolvency creditors.

The aim is to achieve equal satisfaction of all insolvency creditors. This is to prevent the debtor from taking legal action for his own personal benefit or for the benefit of individual creditors when insolvency is imminent.

Your advantages with our insolvency avoidance insurance

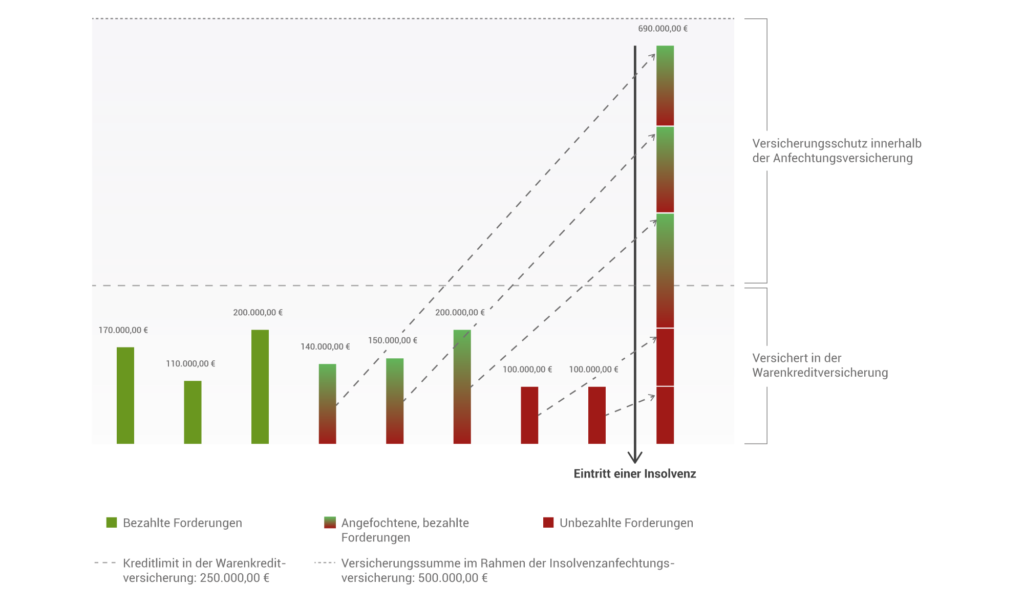

The coverage includes payments you have received from your customers, which are contested by the insolvency administrator in the context of insolvency. As a result of the contestation, the claims are revived and are likely to exceed the existing credit limit under a trade credit insurance policy. Within an insolvency avoidance insurance policy, the insurer protects the contested claims up to a maximum of the agreed sum insured.

Within the scope of insolvency avoidance insurance, legal costs for the defense against damage can also be insured.

• Below you can see how insolvency avoidance insurance can be explained with the help of a diagram:

- Protection against resulting from insolvency avoidance

- Coverage of legal fees incurred due to claims made

- Exclusion of the risk of becoming insolvent yourself

- Limits are checked and insured via the existing trade credit insurance

- Extended coverage for disputes that exceed the limit under the credit insurance policy

- Retroactive coverage up to 10 years

Please do not hesitate to contact us if you have any questions or require more detailed information.

Further information on insolvency avoidance

In 2017, a reform of the law of insolvency avoidance took place.

In April 2017, the German Bundestag passed an amendment to the law on avoidance in insolvency. Unfortunately, the changes listed therein are only marginal, so that the considerable risks for companies in corporate business have not been eliminated. The insolvency administrator retains numerous possibilities to oblige suppliers and service providers to repay payments already made in case of customer insolvency. Furthermore, no maximum limit has been formulated for such disputed claims.

These are the main changes:

Instalment agreements

Payment by instalments or other payment facilities should no longer indicate that a creditor knew of the insolvency of his client.

Payment facilities – including instalment agreements – are now supposed to give the “reverse” presumption that a creditor does not know the debtor’s (impending) payment difficulties. It remains to be seen how the courts will interpret this “reverse presumption” in the future and how it will be integrated into the system of previous case law developed by the Federal Supreme Court, because in principle it seems surprising that a creditor who complies with the request for payment relief should not “get the idea” that his customer has payment difficulties.

In addition, instalment agreements often occur with accompanying crisis indicators, so that challenges, as was very rare in the past, will be based on instalment agreements alone and many of these cases will end up in court.

Reduction of the contestation period from 10 to 4 years

Since most insolvency appeals are already within 4 years, this change has little relevance.

Shortening of the interest receivable

Up to now, the insolvency administrator’s avoidance claims have been subject to interest from the opening of insolvency proceedings. In the new regulation, interest will only be charged from the date of default of the avoidance payment.

Against the background of the marginal changes, companies are well advised to continue to coverage the risk of avoidance within the framework of their existing credit insurance or as a stand-alone solution. The courts will continue to play an important role in the amendment’s interpretation. In conclusion, little has changed in terms of fundamental risk with the reform.

Do you have any questions? Then send us a message!

You have a question? Simply fill out our online contact form and we will get back to you as soon as possible.

Or contact us by phone or email at:

Phone: +49 (0) 221 / 88 88 57-0

E-Mail: kontakt@gfkmbh.com

You receive these and many other benefits when using our free claim service